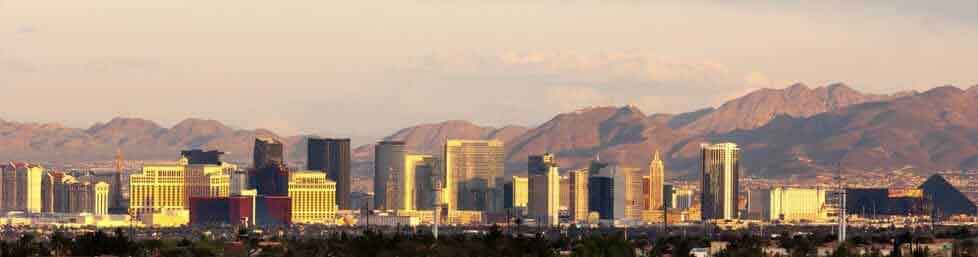

Las Vegas residents count on their insurance companies to protect them from many of life’s unexpected occurrences. Whether it is health insurance, life insurance, business insurance or homeowners’ insurance, we depend on our insurance companies to cover legally allowable expenses and provide us with peace of mind in our daily life.

One thing most of us never consider is what happens if one of our insurance companies goes out of business. It’s sometimes easy to forget that insurance companies are businesses and face the same risks as any other business. They may have an unexpected rise in insurance claims or sell policies at low prices that result in financial difficulties that lead to insolvency.

The role of guaranty associations

All 50 states and Puerto Rico have insurance guaranty associations. A guaranty association will cover insurance claims if an insurance company is declared insolvent. Nevada, along with most states, has a guaranty association for health and life insurance, as well as property and casualty insurance, covering things like automobile and home insurance.

Insurance companies are required to belong to these guaranty associations and regularly pay money into them. This is how the association’s stay funded and able to pay for insurance claims if the insurance company cannot. Therefore, if your insurance company goes out of business, you are likely to still get your claim paid through a guaranty association.

Other options

There may be other available options to claimants in addition to the guaranty association. The Nevada insurance commissioner may take control of the insurance company and try to help solve the financial problems. The insurance commissioner has the power to declare the company insolvent if the financial situation cannot be improved.

If you learn that your insurance company is struggling or has become insolvent, it is important to keep paying your insurance premiums. A guaranty association will likely continue providing you coverage or transfer your coverage to a new insurance company. The process can be confusing and cause distress, so if you have questions, a qualified insurance attorney can help.